We've seen some tremendous moves in Crypto markets over the past few weeks, and I've been fortunate enough to be on the right side of that trade, for most of that time.

There was one point where I got trapped in my short position - just ahead of the Christmas break, but by the time the trade unwound I found myself almost back to even. From there, I managed to stay on the right side of the trade, first catching a powerful snap-back rally in Ethereum, and then swing trading it back down to a near triple bottom.

That was killer trading 👏

— Veteran Market Timer (@3Xtraders) January 8, 2025

Don't mind having tomorrow off, so much...

I could have gone long again, at that point, but after a couple big moves like the ones we just saw, you typically see a prolonged period of sideways consolidation, and this is exactly what we saw on Thursday & Friday.

It looks like Ethereum may be poised to breakout, as soon as first thing Monday morning, but money remains tied up in bullish Energy trades.

$ETH Ethereum Could go as high as $3550 - in the near term

Energy

The Crypto AI & Energy Trades go hand in hand, and this is why you see money flowing from one sector into a next...

How Trump Administration’s Trade Policies Could Transform Energy Markets and Global M&A Deals

And Low & Behold an Energy Deal is announced

Constellation Energy to buy Calpine in blockbuster $16.4 billion US power deal

Search the internet for News and you will hear the, "Power demand for AI" narrative, being spun.

If this all seems orchestrated, that's because it is! Investment money has to be put to work somewhere, and today that somewhere is Energy, AI, & Crypto, and I expect this trend to continue for as long as the Tech sector continues to be shunned. Of course AI investment overlaps most everything including Energy, but this is the running catalyst for the entire market, until something else takes its place.

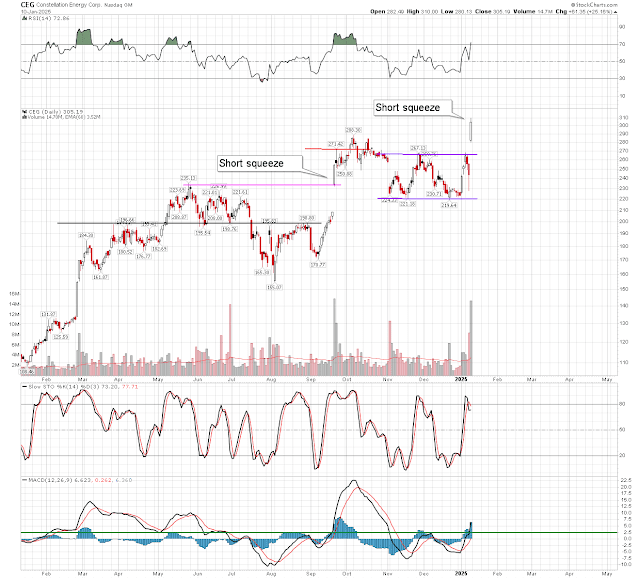

But at the end of the day Friday's trade was just another excuse to squeeze the short sellers, and this is the real reason for 25% Friday rallies in anything.

$CEG Constellation Energy - up another 25%

But Wait There's More!

Want to Cash In on the AI Boom in 2025? Check Out This Electrifying ETF - fool.com

Its top five holdings are:

- NextEra Energy (NEE -4.64%): 11.7% of the fund.

- Southern Company: 6.8%.

- Duke Energy: 6.5%.

- Constellation Energy (CEG 25.16%): 5.8%.

- Sempra Energy (4.3%).

Nuclear stocks jump in the new year as bullish analysts see the AI boom powering the sector

And there you have it!

It used to be that markets would correct one sector at a time, but in an attempt to keep markets from correcting at all, they have found a way to drive one sector, to the next.... while selling volatility, and pumping and dumping certain sub sectors (in order to raise money for the next trade). It's really something to behold, and something I'm still trying to wrap my head around.

It's not all bad. Makes trading easier, not having to worry about bullish capitulation points. Doesn't happen.

— Veteran Market Timer (@3Xtraders) January 10, 2025

Getting back to Crypto

Trading Crypto is highly volatile, which I love - if you'd rather trade something boring then I actually recommend the Dow, for several reasons. 1. It has led the declines over the past several weeks. 2. It's not heavily shorted. 3. Doesn't usually move more than 1%.

Why not? 2X Dow bull $UDOW right now! ....ed the selloff. Low short interest. #DowJones pic.twitter.com/48xNTAuDrt

— Veteran Market Timer (@3Xtraders) January 10, 2025

Target? I would expect to see some profit taking around the 44,500 level, before seeing another breakout to new all time highs.

Take Care, AA

No comments:

Post a Comment