Yesterday was apparently the 2nd biggest percentage gain for the NASDAQ in trading history (Wikipedia), and l loved every minute of it. Of course those who were heavily leveraged on the short side, had a white knuckle moment and it just goes to show what can happen at $VIX 50+

To be honest I think stocks were poised to rally into the Easter holiday, even if Trump hadn't given signal, as I reiterated a couple days ago (my bullish call linked).

Scott Jennings Defends Trump's Advice to 'Buy' Stocks Before Tariff Pause - Newsweek

I saw "Be Cool" trending on twitter, and that's a term I've used before to tell traders not to panic, but I missed the context of Trump's tweet.

Proof Trump's people have been following me for a long time:

Here I am using the same phrase during a market pullback in 2018, and 2013:

And here I am again; doing the same thing during the 2020 crash:

We're gonna be cool... like Fonzie #NoFear https://t.co/vqlh6gc7D6 via @YouTube

— Veteran Market Timer (@3Xtraders) February 20, 2020

Notice the hashtag #NoFear

Yesterday

Be Cool https://t.co/yW8LonwCFR

— Veteran Market Timer (@3Xtraders) April 9, 2025

I don't panic at the bottom, I panic after I find myself up over 40% in 1 day, and I can assure you, I sold everything, and even pulled my wife's 401k...

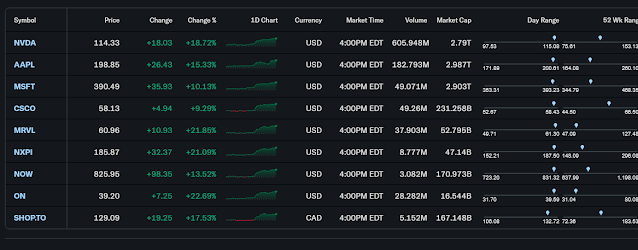

To give you some idea of the gains we saw in the beaten down stocks, I told you to own only 3 days ago

Legendary!

So now what?

So now we're left with more uncertainty, and the short sellers are trapped going into another long holiday, and I'm in no hurry to put on another trade.

After the massive moves we've seen recently; stocks need to settle, and that gives me time to get caught up on my charting. I've gone from trying to find a bottom, to pinpointing resistance levels, and today we're trading somewhere in-between, and as usual I'm not giving away any targets.

I think the market can rally higher, now that the bears are trapped, but I also think we could see these gains quickly disappear, and that's why I panic-sold at the top.

This I can tell you; Chart patterns that used to work, are broken, support is broken, and I'm afraid of what may happen to global markets over coming weeks/months.

The bond market did finally roll over, but this is nothing to be alarmed by.

Stocks, Bonds, Real Estate, Even Gold needs to correct, after the ridiculous liquidity bubble that's been inflated over the past several years.

Both Trump and Biden own this bubble; each trying to outspend the other; in fact after the last blog, in which I questioned if we could trust Trump's judgement, I came to the conclusion that he did indeed crash the market in order to force the Fed to lower the borrowing rate, so that he can pile on massive amounts of debt, just as Ronald Reagan did during his presidency.

Trump proposes spending more on defense, taking a page from the Ronald Reagan playbook. Some of us are old enough to remember the star-wars campaign, aka the SDI https://t.co/QC7wZ9cx9n

— Veteran Market Timer (@3Xtraders) April 8, 2025

I believed Trump was going to make some historic trade deals, and that the bubble could continue, but now the chart patterns have changed, I'm left with a lot of uncertainty, and many broken charts.

Take care, AA

No comments:

Post a Comment