We're seeing ROW (rest of world) ex-US hitting all time highs. You'd think Bloomberg would be bragging about that historic comeback, but maybe they're too busy reporting 9 day winning steaks...?

$VEU Vanguard FTSE All-World ex-US ETF - hitting all time highs

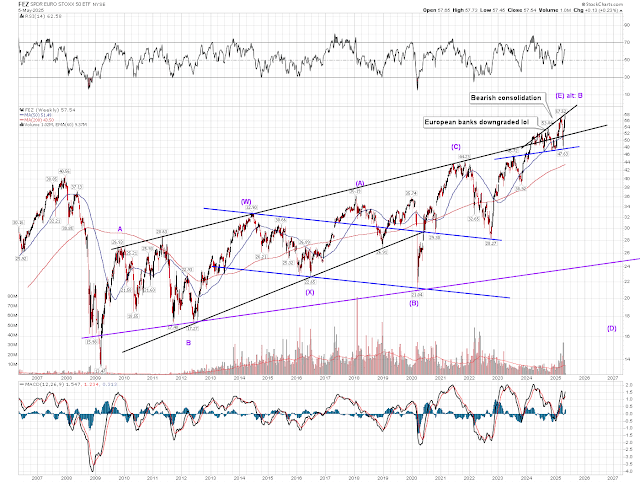

EURO STOXX 50 ETF - hitting all time new highs

Japan

$EWJ (MSCI Japan ETF) - testing the top of a range.

You know who is heavily invested in Japan, right? Buffett

68 days ago: Japan’s trading houses surge as Buffett's Berkshire looks to boost stake https://t.co/ZN5rpH9QZ7

— Veteran Market Timer (@3Xtraders) May 4, 2025

$BRK/A - Berkshire Hathaway - New all time highs followed by a nearly -5% decline on Monday's (sell the news) event, and I think nobody has more to lose in the next stock market crash than Warren Buffet.

Netflix $NFLX

I think it's time Netflix $NFLX #StocksToSell pic.twitter.com/zBzFZqdWtx

— Veteran Market Timer (@3Xtraders) May 1, 2025

Gold & Gold miners

Gold miners finally make their run as predicted weeks ago, but what took so long...?

I told you they were going to dump bitcoin, and pile back into Gold, and $GDX gold miners. It was just a matter of time... https://t.co/PWNNY7vXGy

— Veteran Market Timer (@3Xtraders) May 6, 2025

The chance of nuclear war between India and Pakistan was clearly the catalyst that Gold needed, for a powerful snap-back rally

Then came the reversal:

Golds sudden reversal pic.twitter.com/lnafUefytl

— Veteran Market Timer (@3Xtraders) May 7, 2025

Gold prices fall in India amid global trends and geopolitical tensions

Bitcoin

No sooner than Gold reversed, we saw a sector rotation back into Bitcoin. I believe that in part, this was due to the fact that Bitcoin priced in Euro's had decoupled from the Bitcoin priced in $USD trade, as speculators continues to rotate from one sector into another, and I think this will continue until we see a deflationary spiral take every market lower.

What Next?

What next is the FOMC statement, and Chairman Powell's speech

Regardless of what the Fed statement says, there is a 90% certainty that markets will rally on the news.

Nasdaq $NDX futures being held above 20k. #DowJones 41k

— Veteran Market Timer (@3Xtraders) May 7, 2025

9 times out of 10 you're going to rally on the Fed #FOMC statement. pic.twitter.com/4C7fZ7rBsg

From Saturday's update:

I suspect the next Fed meeting could provide a near term capitulation point for global markets.

GL, AA

.png)

No comments:

Post a Comment