Wow, where to start?! Just when you thought we were headed into the summer doldrums, we get more explosive market action, and I've had the good fortune of being on the right side of nearly all of it.

I offered a chart of the small-caps earlier in the week (in the previous blog linked), and all they've done is out-perform, but like I said at the time I have much better trades up my sleeve, and I was "willing to share... for the right price". That offer is off the table.

It seems like all I do is blog on one great trading opportunity after the next, and this during the summer - when trading is typically slow.

That's the good news

The technicals are working like never before, and today when I hear analysts talk about "valuation" I just have to laugh. The market doesn't care about facts.

The most obvious case to be made that the market no longer cares about facts is the valuation being placed on Bitcoin, which continues to trade over $100k.

There's nothing new under the sun

I did a little digging this morning, and I was shocked to find that the Euro was actually created as a digital currency. I guess I had never really thought about it, and I was actually searching for the date it was created, when I stumbled upon this fun fact.

The euro was officially created on January 1, 1999, when it was introduced as an electronic currency for financial markets, and euro banknotes and coins began circulating on January 1, 2002. Ho Lee Fuk! Source AI (duck) assist #EU $EUR/ $USD pic.twitter.com/3aTQgLPpnp

— Veteran Market Timer (@3Xtraders) June 25, 2025

I find it very interesting that the EURO was created just before the tech bubble imploded.

Is the Euro as worthless as Bitcoin? I suspect it is, considering that it has continued to trade in a bear market, ever since just after its creation.

And here's another fun fact: Who is going to get hurt the worst when the Euro goes belly up?

Germany

The idea that the euro favors Germany is politically controversial, but there is some support for it. investopedia

Several nations including China are relying on the EU to save their failing economies, and I have a prediction to make. This won't end well for any of them!

What does the market care about?

I've been tracking markets closely for nearly 15 year. I've watched as the perma-bulls have done everything in their power to keep market corrections from happening, and to some extent they've succeeded, except for the sudden market crashes we see every few years, as we recently witnessed back in April, when the $VIX was driven from 30 to 60, in 2 days, before seeing the biggest short squeeze on the Nasdaq in history.

Today we see the $VIX trading back below 20, after briefly testing the 22 level, on news that we were headed for a broader conflict in the middle east, with most investors pretty much ignoring the possible outcome. The market doesn't care about facts.

At least Oil markets couldn't ignore the news, and I suspect that the Oil bulls haven't figured out how to manipulate the Oil $VIX (the $OVX), as easily as they do the $VIX.

$VIX - being sold at the 5- day moving average - this is one of the few things the market cares about

Technically they will try to tell you that the $VIX can't be directly traded, and while that may be true, there are other ways of manipulating the $VIX, and I've blogged on this topic at nauseam.

Yesterday the market cared about the "dash for trash", which I predicted back in March, and I reaffirmed it in several subsequent blogs. They even managed to drive Bitcoin up 5%.

Bitcoin leads semiconductors, and AI stocks higher. Let that sink in $BTC #Crypto #Coinbase pic.twitter.com/bW0QliDJQ7

— Veteran Market Timer (@3Xtraders) June 25, 2025

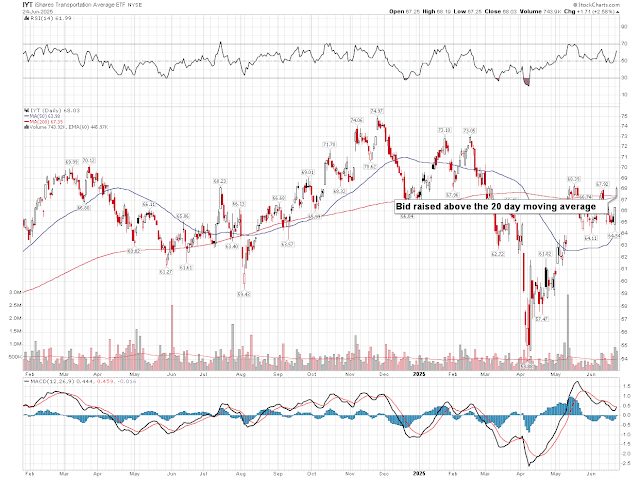

As usual I'm not giving away my trades, or handing out any valuable charts, but I can give you 1 more great example of what the market manipulators have been up to, as the 4th of July break draws near, and all the market cares about at the moment.

Trapping the short sellers

Take Care, and have a great summer vacation,

AA

.png)

No comments:

Post a Comment