I decided to look for support on the Nasdaq this morning, and I didn't have to look too far....

Some of you may be asking, why would you be looking for support, rather than a top?

That's because markets tend to overshoot, and especially in the type of pattern we're trading in. Plus you see short squeezes this time of year, and that can cause markets to overshoot.

You'd be hard pressed to find the absolute top, and sell it precisely.

This leaves you with 2 options:

1. You can either sell into strength, and scale in over time.

2. Or you can wait until you see support break, and pile on...

I always prefer to sell into strength, but that can get you into trouble, especially if you start building a position too soon, or at the wrong time.

This is really the wrong time to sell, because short sellers are covering ahead of the long Thanksgiving holiday, but I suppose this time could be different.

We've seen the windows dressed, and many funds are closing their books on a blow-out year - if you were overweight tech. To give you some idea, there are certain tech funds that are up over 40% for the year!

$FSPTX - Fidelity Select Technology - for example -

I suspect the bulls won't take profits until after the first of the year, so they pay lower taxes.

I can't share any of my Nasdaq charts, because they're just too valuable, and the hedge funds don't deserve any help from me.

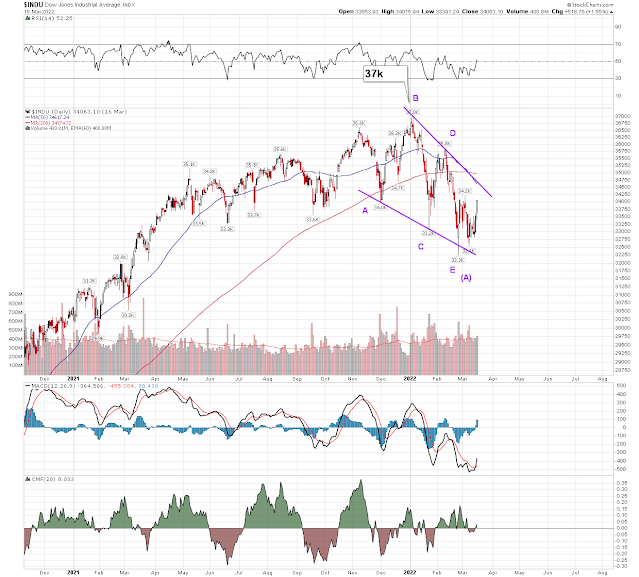

The broader market:

I can share with you an interesting view of the New York Stock Exchange chart, because it doesn't give away any targets.

$NYSE - in contrast hardly even up for the year. 2% maybe? I'm also seeing several bearish indicators, including a right shoulder target, near the top of the same range we've been trading in since march.

Here's some easy homework: Pull up a 3 year (DCS) view of the Dow Jones, and count the number of times it has tested this 35,000 level.

I can't say that the market is going to sell off any time soon, but I sure as hell wouldn't be chasing it up here.

Take care, AA