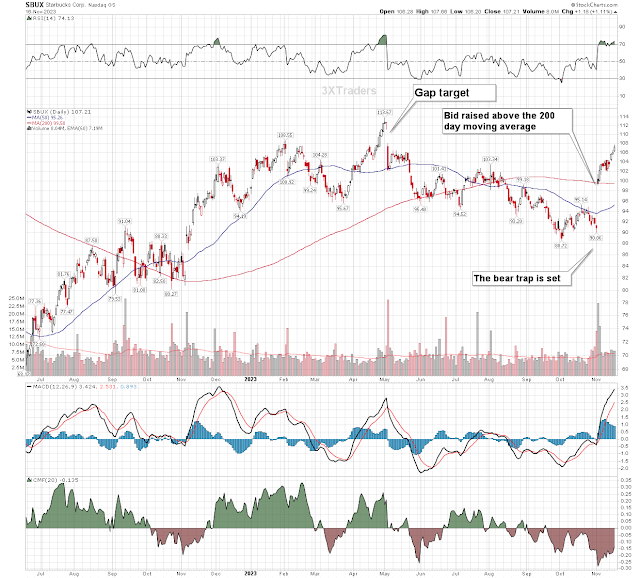

Does this rally have legs?

The short answer is no. Sure, we could see more short covering as we get further into the holiday season... and money managers are being forced to chase gains into the end of the 4th quarter (window dressing), but this is a low volume - short covering - rally, just like we saw back in July.

I recognized this several months ago, when I pointed out that retail was being sold (shorted), ahead of the holiday shopping season. See the weekly update blogged Friday August 25, 2023

Looking at Yesterdays Bearish Engulfing Pattern

"Some hedge funds returned from their summer break early, in order to try to shake the weak hands, on light summer volume, because they don't want to be forced to chase a summer rally.Who else would be taking retail down, only a few months ahead of the holiday shopping season?Eventually these hedge funds will be forced to put money to work, and probably sooner, rather than later."

Walmart $WMT - Walmart is an exception. Instead of selling Walmart ahead of the 4th quarter, Walmart was driven to new all time highs, before it was suddenly dumped yesterday.

Same could be said for names like Cisco, which was recently pumped to 2 year highs, before giving back nearly all the gains of 2023.

Cisco $CSCO chart - this is a good example of why you should always be suspicious of fake headlines, like 18 month highs, and 10 day winning streaks, which are nothing but catch phrases, designed to trigger animal instincts.

This must spook some money managers, and I suspect the buying frenzy we've seen over the past few weeks is about to come to an abrupt end.

Financials tell a story - see all the gaps being left behind on the chart? Those point to panic buying, by the short sellers, but most gaps fill within a certain amount of time.

Speaking of Gaps

No comments:

Post a Comment