Black Swans & Debt Time Bombs

Firstly: India rolls over, after calling that market out last week. That's what I call, "perfect market timing".

So, is this the beginning of the global collapse? I don't think so. The IMF just raised it's global growth outlook, and the Fed is way behind the curve.

Technically speaking, we're very early in a bearish cycle, if this even is one, and either way, I think we're years away from a total collapse.

We see energy still trading near all time highs, and that just doesn't point to contraction.

I still believe we're setting up for a nasty correction, and the controllers are already pushing several bearish narratives.

CNBC actually brought several guests on yesterday, so encourage folks to straight up, "short Tesla", after the magnificent rally we've seen over the past week.

January 26th, 2023 - $TSLA - bottom called perfectly, just one day after the lame stream media was reporting, "the worst trading day for Tesla". This is how it's done!

TESLA SHARES UP 10% IN A SHORT SQUEEZE #ShortSqueeze $TSLA @elonmuskhttps://t.co/NObJwWi2EM

— Veteran Market Timer (@3Xtraders) January 26, 2023

I think Tesla could consolidate, after the big run it's had, but I think anyone who is looking to short Tesla, for no other reason thay they don't like Elon Musk, have a screw loose.

Meanwhile Chevron, which missed earnings, is being trashed, just after last weeks CNBC pump job, and now, not a word from the talking heads! Don't say, I didn't warn you...!

Speaking of Energy: It looks like the powers be used last weeks Flash Surge to take profits, and sell the energy space.

A couple energy names I forgot to mention last week, were BP Amoco, and Marathon $MPC, but traded to new highs....

$MPC -

Gas Shortage?

Looks like we could see a refinery shortage already being priced in...

Why Is Gas So Expensive Lately? entrepreneur.com

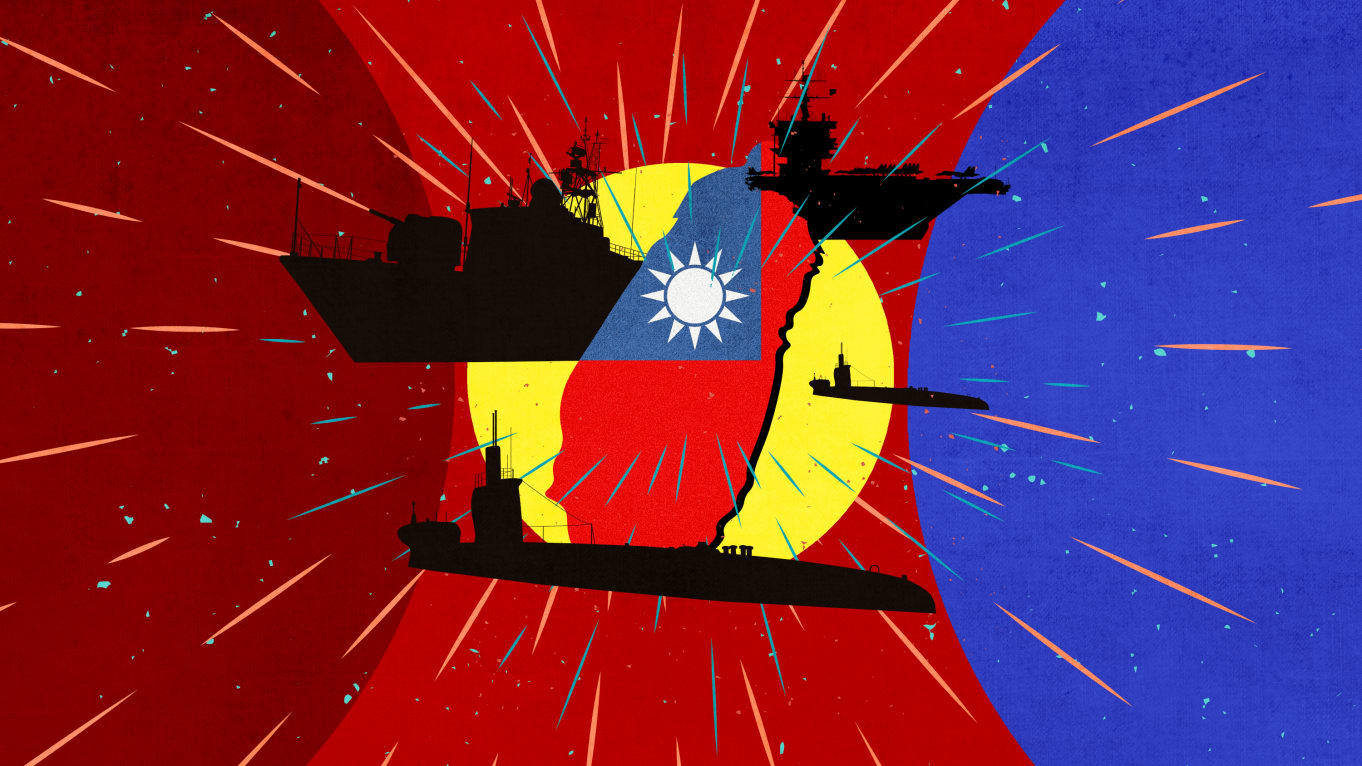

But the manipulation of a hanf full of stocks is nothing, in comparison to the way they've turned - on a dime - on China, complete with the return of the threat of war (story) , as China threatens the new Speaker Of The House, not to go to Taiwan. "New Boss; Same As The Old Boss"!

How America Would Be Screwed if China Invades Taiwan

thedailybeast

Senior US general warns of possible looming war with China globalvillagespace.com

China Warns Against US House Speaker's Plan To Visit Taiwan bangkokpost

|

| DailyMailOnline |

Black Swans & Debt Bombs

Black Swan Fund Manager Sees ‘Tinderbox-Timebomb’ in Financial Markets bloomberg

The ‘Black Swan’ fund manager just said that debt is creating the ‘greatest tinderbox-timebomb in financial history’ and could have consequences similar to the Great Depression fortune

How Debt Limits Could Lead to Black Swan Events For Wall Street ibtimes.com

Of course all the above stories look like false narratives, but spreading disinformation, is what they do best!

FOMC Announcement

FOMC is tomorrow, and since the Money Printers are already trying to create a panic, I would expect The Fed to oblige, by coming out Hawkish.

We could get the normal reaction to The Fed, as uncertainty is removed, and a little relief rally... especially in the banking sector. Higher interest rates are going to be good for the banks, at least initially, and the $BANK index continues to consolidate above the 40 month moving average.

Fixing a mistake I made last week:

Big Tech

It was the $NDX which rallied to the 12k target, not the NASDAQ, and just so happens that's exactly where Big Tech is set to open this morning.

Take Care, AA