The Dash For Trash Continues... BUT For How Long?

This is one of the things I was talking about yesterday. The massive moves we see in after hours trading...

Case in point: Carvana up 38%

Carvana $CVNA up 37%? What a gift... pic.twitter.com/TAqFc0zCxc

— Veteran Market Timer (@3Xtraders) July 19, 2023

I wonder if one of the big banks put Carvana execs up to this, or did they come up with the timing of this announcement on their own?

Speaking of timing: Tomorrow is Options Expiration, and that explains why you're not likely going to see a whole lot of movement in stocks, between now, and Friday's close.

Speaking of OPEX. Manipulation of the Options market, should've definitely be in the top 5 of Everything That's Wrong With This Market (as I blogged yesterday)

Case in point:

Tesla $TSLA closes in on the $300 strike price:

Tesla $TSLA earnings are just about priced in, just in time for

— Veteran Market Timer (@3Xtraders) July 20, 2023

monthly Options Expiration OPEX https://t.co/JtDAqf0G2t

If you remember, I've remained bullish Tesla for some time, and even called for the short sellers to be trapped back in June

QQQs component Tesla to gap above resistance and squeeze the short sellers #ShortSqueeze $TSLA $QQQ pic.twitter.com/vcYrjy4zB5

— Veteran Market Timer (@3Xtraders) June 9, 2023

Am I including Tesla in the "Dash Fo Trash" category? Of course..!

This rally has been all about squeezing the short sellers, many of whom remain underwater in their trades since May.

Wall Street dirty tricksters love this - dash fo trash - trade

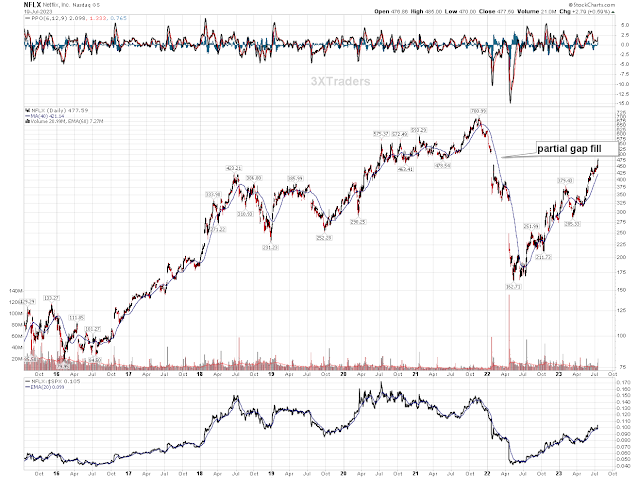

Even Guy Adami, on yesterday's show, was pointing to a gap target that was left behind in Jan., 2021

Anyone who is subscribed to the Newsletter, knows I've been pointing at gap targets for months.

Of course I under-estimated the length and duration of this rally, and this morning we see small caps continue to run in a risk-off environment.

$SPX #DowJones Futures flat. Russell 2000 breaks above 2000. pic.twitter.com/gxkoj9bjxj

— Veteran Market Timer (@3Xtraders) July 20, 2023

The Dash For Trash Continues... BUT For How Long?

I'm thinking this market will continue to hold up into tomorrow's close, like I said, and since nobody is going to want to be short going into the weekend - ahead of the next FOMC announcement - there's a good chance that the rats will jump ship, and pull the rug out Sunday night - futures.

If that doesn't happen, then the next opportunity to sell would be Technical Tuesday.

The FOMC could be used as a sell the news event, but that's highly unlikely.

Other dates to watch:

A full moon Tuesday August 1st - could mark the end of a sell-off.

A Summer Banking Holidays in Europe

August OPEX comes early on the 18th. - could MARK the end of a pullback, and another opportunity to squeeze the short sellers into the next holiday.

Sept. 4th, Labor Day Weekend

Sept 11th, Money must be put to work.

Monday, Sept. 15th, another early OPEX.

Rosh Hashana

As you can see the windows for a sell-off are awfully short

Sept. 20th, there's another FOMC Announcement

I guess we'll know it when we see it, but even a pullback to support, is going to look like an overbought condition, at this point.

In other words, even if the market was to give back a week's worth of gains, in 2 day's it wouldn't even signal a bearish reversal.

Good luck,

AA

No comments:

Post a Comment