This week was hell! Not because trading it was all that difficult, but because I came down with the flu, and I'm still fighting it - sneeze - and if that wasn't bad enough, now my wife has it.

Next Bloomberg @chartress brought one of their so-called experts on to explain why the $VIX remains so low, yet all he could come up with was that Put protection wasn't being put on.

I can tell you why the $VIX remains low. It's because the market isn't expecting high volatility, anytime in the near future.

Sector Rotation

What Bloomberg failed to report yesterday, as did CNBC, or anyone else in the lame stream media, as far as I can tell, is that the regional banking sector gaped up nearly 3% at the open.

While most traders are watching the $SPY, and the $NDX

— Veteran Market Timer (@3Xtraders) October 26, 2023

regional banks are on fire #Financials #Investors #Stocks pic.twitter.com/OqED4i4ryo

Perhaps that story doesn't fit the Bloomberg narrative, or maybe they were preoccupied hosting/ interviewing Janet Yellen

Janet Yellen is on Bloomberg lying her ass of to help Joe Biden pic.twitter.com/mCszjqaraa

— Veteran Market Timer (@3Xtraders) October 26, 2023

China

The lame stream media also failed to report China up nearly 3% on Tuesday

Oil sells off. China rallies. Don't suppose bloomberg even mentions it. The rest of the market is pretty drab

— Veteran Market Timer (@3Xtraders) October 24, 2023

I was lucky enough to catch that trade, and even though I was afraid I might miss another big move to the upside, I took profits, and subsequently the rally was faded.

Big Tech

I warned folks to not hold big tech into earnings, and low and behold I was right again!

Now, aren't you glad you didn't own tech #Stocks #Nasdaq $QQQhttps://t.co/V7Jk0o7r3b

— Veteran Market Timer (@3Xtraders) October 26, 2023

If markets manage to stage a rally today, it's going to look like short covering ahead of the weekend, but if the $VIX is taken down below 20, then this rally has legs

Judging by the way all the bears on CNBC Fast Money continue to badmouth stocks, we could see a massive short squeeze...

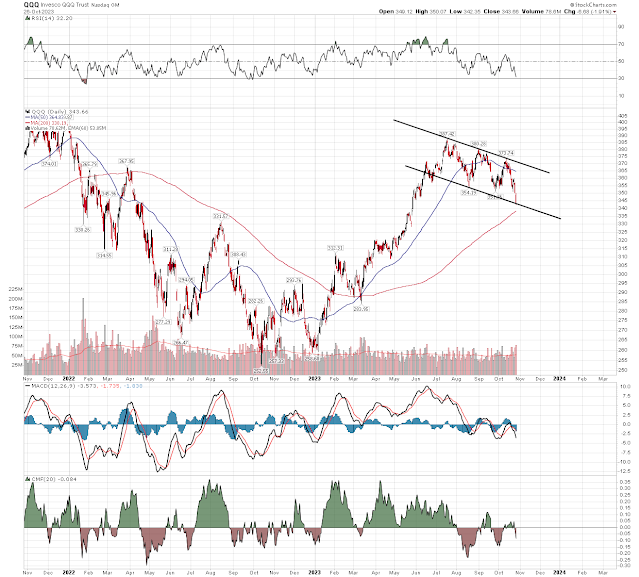

Technically It comes down to whether you trust the channel on the QQQ, or the 200 day moving average target.

$QQQ - trades in parallel range

The $NDX looks identical, by the way.

One possibility is that we get a rally here, and the 200 day continues to rise, providing additional support at the lower channel.

The $COMPQ has already taken out the 200 day moving average.

Another possibility is that we see other sectors lead the rally, while tech continues to sell off.

Take Care, AA

No comments:

Post a Comment