Looking Back At Monday's Market Action

Looked like your typical Mutual Fund (buying) Monday, but on steroids!

News helped move markets

Hedge Funds Add Meta, Apple on Tech Rally, Cut Alibaba: 13F Wrap yahoo.com

Calling this the copycat trade, which is not any different than the buffet effect.

Monkey see; monkey do!

Speaking of Monkeys

On Friday CNBC fast money traders were bearish semiconductors. $SOX

— Veteran Market Timer (@3Xtraders) August 14, 2023

Monday $SOXL rallies 8.5% 🤣 @CNBCFastMoney

CNBC fast money monkeys were bearish $NVDA and Semis on Friday, and no sooner than they start predicting a "10% correction..." NVIDIA rallies 7%. Boom!

One of the biggest moves we saw yesterday was in $SOX - up nearly 3%!

Like I said in this weeks weekly Newsletter, you should always do the opposite of whatever CNBC fast monkeys are predicting!

I called out the long Tech trade on Thursday:

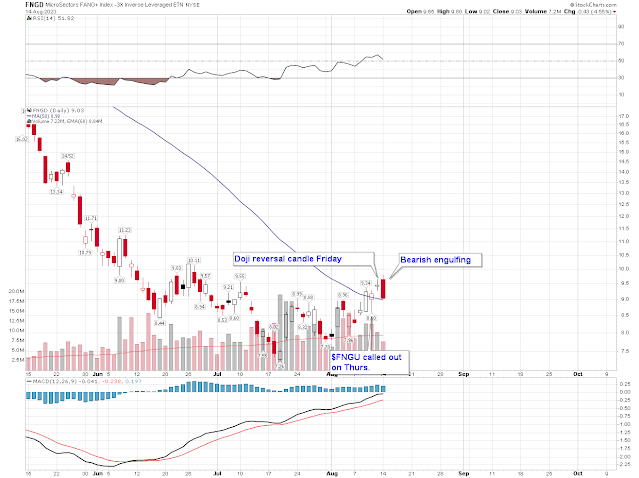

Apple $AAPL builds a base. Liking $FNGU on this pullback #Tech #Stocks pic.twitter.com/Xhg7AHVkNl

— Veteran Market Timer (@3Xtraders) August 8, 2023

$FNGD - I like to use the bear ETF's when charting leveraged funds.

It wasn't a great call, but I'll take it. The market action still generally sucks.

I'm not too sure that yesterday's rally has legs.

I was hoping to find a trade in energy, but it just seems to retest the high every day, just as the rest of the market continues to retest the lows.

Speaking of new lows

We saw a shakeout to the 50 day moving average, on the Russell, yesterday, however we still have not seen the 50 day on the $SPX taken out.

There's still more work to do, I'm afraid, and seeing $SPX futures down again this morning.

For my expanded outlook; see yesterday's update (linked)

Take Care,

AA

sss

No comments:

Post a Comment