The biggest thing I noticed on August Expiration Friday - besides the bearish reversal on the $VIX - was the bullish reversal on the Russell 2000.

Best trade of the day was the bullish reversal on the Russell 2000. Probably continues to build a base next week.

— Veteran Market Timer (@3Xtraders) August 18, 2023

Most everything else I'm watching remained pretty much pinned throughout the day, on Friday, which confirms what I was saying last week; the market remains totally rigged according to Option Expiration dates.

I can't say that I have a good handle on the broader market, but only because I don't spend a lot of time charting it. I have bigger fish to fry.

$SPX - without revealing the chart I would say, watch for the S&P to build a base around the 4300 level.

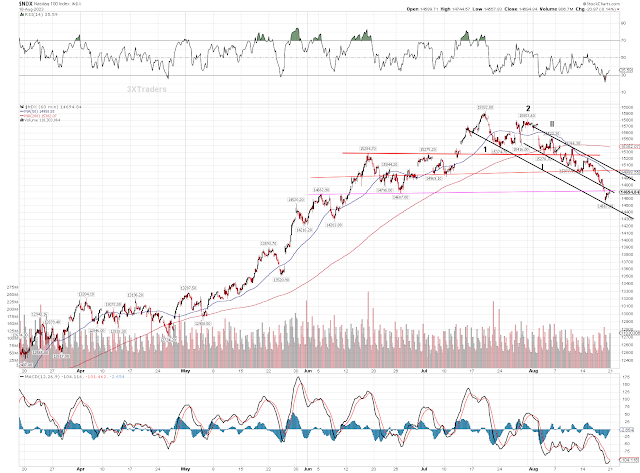

The Nasdaq

$NDX (60 min chart view) It looks like it's going to be allowed to bounce out of the hole this morning, but the trend remains lower, and I wouldn't be surprised to see the selling continue into Jackson Hole.

As I said earlier in the month

Confucius say: "What goes up, must come down", or was that Tom Jones? #Stocks #Stockmarket #Nasdaq

— Veteran Market Timer (@3Xtraders) August 3, 2023

Watching China closely

This is where we've seen most of the selling, and at some point that's where we're going to see the biggest gains.

Remember when Morgan Stanley upgraded China right at the end of 2022? Now, 8 months later now, the idiots downgrade China

Morgan Stanley upgrades India to 'overweight', downgrades China

Heng Seng -

I like China right here, on a pullback to the key Fibonacci target, at the lower end of the range!

I'm watching several other sectors including gold, and it's always good to be diversified, whether you're long, or short.

孤注一掷 – gū zhù yī zhì – “To concentrate one’s strength and resources on one thing” blogs.transparent.com

Translation: He who puts all his eggs in one basket, may end up with yolk on face!

I'm outta time,

AA

No comments:

Post a Comment