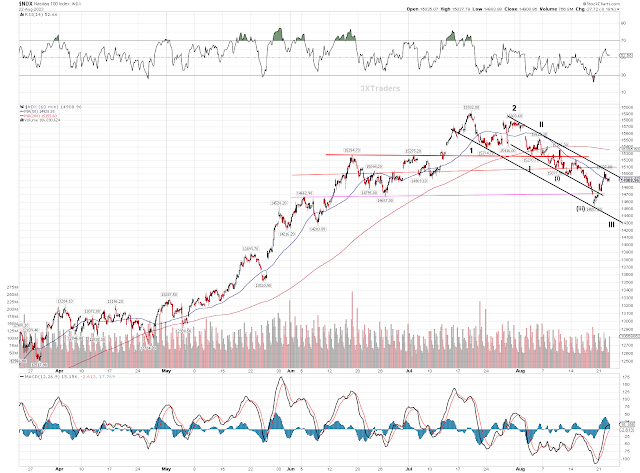

No change since yesterday, really:

$SPX futures are obviously being held above the psychologically significant 4300 level. That's pretty easy to do, on such light volume. In fact it's about as easy as running tech stocks up on light summer volume, and then holding the sector up, into Sept.

The $NDX topped out, and reversed, as expected. Maybe we chop around in a range, ahead of Jackson hole?

China

China continues to bounce off the recent lows, with no real explanation from the lying lame stream media.

I did find a story about, "some traders talking about 1 oversold technical indicator, but with no evidence offered - unless you pay... sounds like a scam to me.

The lame stream media; instead of focusing on reality, points to a retest of the highs in shares of NVIDIA $NVDA, and they continue to sell it as an AI boom.

Meanwhile: Several retailers are seen crashing

Dick’s Sporting Goods Blames Earnings Slump On Theft—Joining Other Major Retailers forbes.com

US Home Purchase Applications Hit Lowest Since 1995 on Rate Rise yahoo.com

Of course the market could take all the above and turn it into a bullish narrative, because there is no doubt that the Fed will soon be lowering interest rates, and may pivot as soon as this week, at Jackson Hole.

I've barely had time to scratch the surface this morning, but I have added a link to my longer term outlook - which I provided on Monday - in the left hand side menu.

Add to that the fact that the bullish trend that we were watching in June, is broken.

Does this mean the $SPX isn't going to 6500? #SPY pic.twitter.com/TDJFRYLeB7

— Veteran Market Timer (@3Xtraders) August 22, 2023

Take Care,

AA

No comments:

Post a Comment