Groundhog Day Markets Continue

In other words; if you choose to trade the broader market, it's the same old, same old, every day, and it looks like bifurcated markets are here to stay.

1. $VIX continues to be hammered in order to prevent program selling from being triggered, while the lame stream media continues to push, "soft landing", theory.

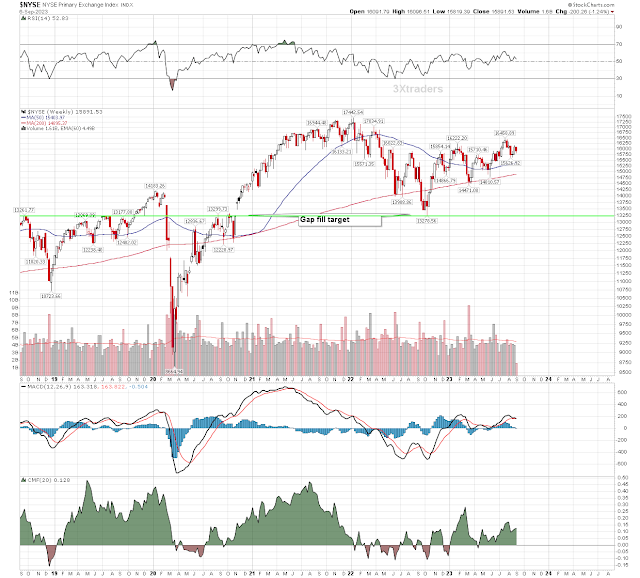

2. The broader market remain mostly unchanged for the year. That may come as some surprise to followers of CNBC pump-monkeys, but the charts don't lie.

Even Carter Worth chimed in on this - on Twitter - a couple days ago:

The first trading day after Labor Day 2 years ago, Tuesday, Sept 7, 2021... to today, the first trading day after Labor Day, Tuesday, Sept 5, 2023.

— Carter Braxton Worth (@CarterBWorth) September 5, 2023

What a bloody waste of time!

Unchanged, 2 years later.

Max gain: +6.8%

Max loss: -22.8%

Net: UNCH (groan)… pic.twitter.com/BgElRM6xkF

$NYSE - remains about UNCH for the year

3. We saw tech stocks pumped and dumped over the summer, along with other junk stocks, and sectors such as Airlines, and Casinos, not to mention China, and Home Builders.

$ITB US Home Construction - breaks out to all time highs

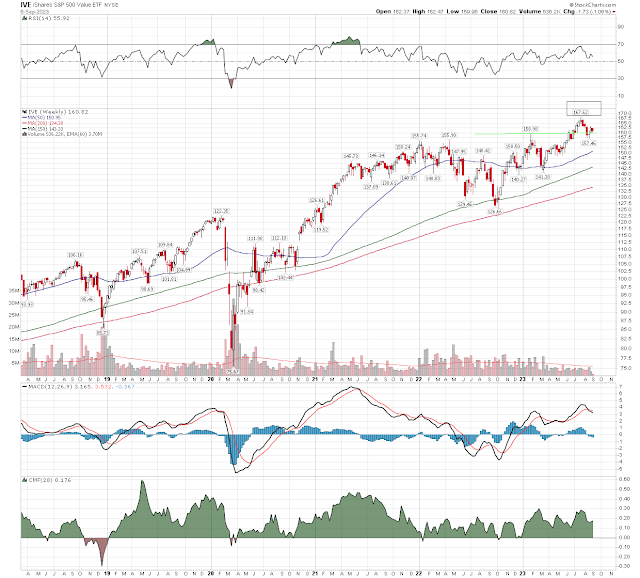

Is it any wonder investors have turned to chasing stealth rallies in individual sectors, and Spiders?

Speaking of Spiders:

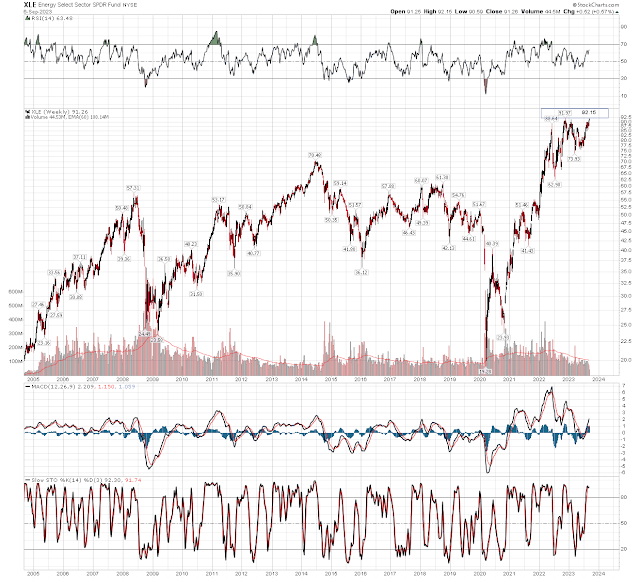

The $XLE Energy Select Sector SPDR NYSE can be seen testing the all time highs

$IVE/ $SPX value fund also trading at all time highs

$SMH VanEck Vectors Semiconductor ETF - trading at all time highs

Energy

4. Energy stocks continue to rally to new 1 year highs - namely marathon, BP Amoco, Exxon Mobil. and British petroleum, of course.

Remember when I predicted that Exxon would continue to hold above the $100 level indefinitely, just so that the $100 call strike options would continue to pay for months on end? Well, here we are more than a year later....

- this is nothing new.

---------------------------------------------

But There's Something Different About This Market

What's different is the zero day to expiration daily options market, and how it's being used to sell (short) volatility, with impunity.

Remember the warnings of a Volmageddon part II? Well, as it turns out, those predictions were misguided, and it just goes to show even JP Morgan can be consistently wrong, and the same could be said for Morgan Stanley's Mike Wilson, who was recently seen being trolled by Jim Cramer.

This is beyond what I would call cocky, over-confidence; something Cramer himself warns against.

Getting back to the sideways market, and the lack of volatility

There is a good technical reason for all this sideways consolidation, and even though this is bound to play out for a good while longer, there will be better trading opportunities ahead.

Following the big moves we saw in 2020 - when governments started over-stimulating, and printing money out of thin air, there needs to be a longer period of consolidation.

So far, all we saw in 2022 was a gap fill target.

$NYA New York Stock Exchange - Looks like continued sideways consolidation

Of course I have downside targets, but I'm keeping those close to my chest.

This market is really no different than any other market, despite what some people think.

After greed, comes fear, and capitulation, just like we saw when the covid story was used to drive the $VIX To 100, and there's an old saying... "never let a crisis go to waste".

There will be plenty more engineered crisis, and I'm sure the next one is already in the works.

It's just a matter of time, before the next market crash, and since the bulls think this is a new market, in which capitulation points are a thing of the past, the next one could be a real ball buster.

My suggestion is to get away from the $SPX/ #SPY, as I've been telling folks for nearly 2 years.

Sector trading is where it's at, and probably not the endlessly rigged (higher) tech sector.

There's always a trade somewhere

The #gold trade $GLD pic.twitter.com/McJ2cNJqaY

— Veteran Market Timer (@3Xtraders) September 6, 2023

The $VIX broke out slightly yesterday, before it was hammered back below the 50 day moving average. This felt more like a bear trap, or a test, than fear in the market.

Next week is Options Expiration, and money managers are going to be forced to chase performance when they return from the summer break. That alone is enough to hold markets up a little longer.

Congress is already back from summer recess, and we know how they love to create trading opportunities.

Perhaps we see the correction continue in Oct., but it's too soon to say.

Take Care,

AA

No comments:

Post a Comment