It's That Time Again! Time For A Government Shutdown?

No, it's time for buying volume to pick up, now that Yom Kippur has passed, and hopefully we don't have to wait too long, because Tom Petty said - it best - when he sang "Waiting Is The Hardest Part".

I digress, but the market was super slow again yesterday, and the fake news adds insult to injury!

If you caught yesterday's market update; then you already know why the market hardly moved on Monday, and just as I predicted, the lame stream media didn't say a word about the Jewish Holiday.

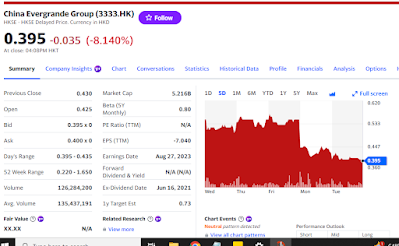

They were instead seen ramping up the negative news on Chinese real-estate developer Evergrande, while at the same time pointing to the next big holiday over there (Golden Week).

Evergrande’s plan to stave off collapse is running into trouble cnn

Also In The News:

Nothing ever happens during a government shutdown. This is just liberal fear porn (#fakenews), ahead of another election.

— Veteran Market Timer (@3Xtraders) September 26, 2023

Biden will join the UAW strike picket line. Experts can’t recall the last time a president did that AP

I digress, but where there isn't any real market movement to comment on, I'm left to analyze the fake news.

Going to the charts

$INDU back-tests the 200 day moving average, filling a gap - on the chart - that was left behind, back in August. The Dow actually ended up for the day, painting a bullish hammer candle.

All you need to do is go back to late May 2023, to see why this test of the 200 day ma is important.

I was going to alert that Dow target yesterday, but it seemed so obvious I didn't even bother...

What I didn't realize is that this was going to result in 3 - count 'em 3! - bullish indicators, not to mention a bullish mid-day reversal!

It's no wonder CNBC was seen this morning, pointing to market futures in the red (sense the sarcasm).

It doesn't take a genius to read this market

Tiny market moves, on light volume/ volatility; ahead of the holiday season; all points to bullish consolidation.

How dumb is this tweet?

Peak of M.O.A.B. (Mother Of All Bubbles) will be known as the G.O.A.T. (Greatest Of All Traps). $SPX and $VIX 1990 to present. pic.twitter.com/JeTQj6pTBc

— Ponzi Finance (@BP_Rising) September 25, 2023

Looks like another bear trap, as I've been saying all along; I suppose the most hated rally of 2023 will be off to the races again, soon!

Take care,

AA

No comments:

Post a Comment